Japan's materials makers are pouring money into development and output of cutting-edge products essential to the expanded use of 5G -- the next generation mobile communication standard -- including substances that cut signal loss and devices to facilitate data transmission in high-frequency bands.

The U.S. and South Korea both introduced 5G by 2019 and Japan followed suit earlier this year. The prior 4G standard uses the 3.5 gigahertz band while 5G uses millimeter wave, which falls in the 28-gigahertz spectrum. Many carriers, however, have started 5G services in the so-called sub-6 spectrum, or below 6 gigahertz, frequencies, and plan to expand into millimeter wave in the next few years.

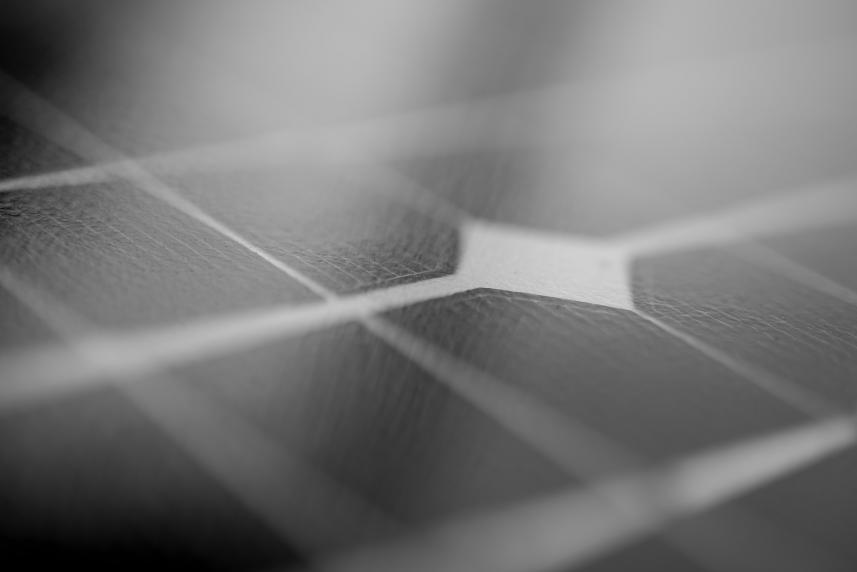

Millimeter wave 5G can achieve transmission speeds 100 times faster than 4G, but requires special devices created with advanced electronic materials.

One such substance is copper-clad laminates, or CCL. Japan's AGC, a major producer of the laminate of copper and nonconducting resin, says that when used with the company's fluororesin in printed circuit boards, the laminate can reduce signal loss in 5G networks by more than 30%. AGC plans to expand production of CCLs, aiming to triple sales of overall 5G-related materials to about 60 billion yen ($559 million) by 2025.

AGC has also developed a small, lightweight glass antenna for 5G networks. Pasted on a windshield, it establishes communication with nearby base stations and electronic devices in the car. AGC has also teamed up with NTT Docomo to develop another glass antenna that can work as a base station when attached to window panes in office buildings.

The company has already built a plant to mass produce those products and plans to promote them across Japan by the end of the year.

Meanwhile, Tokyo's Furukawa Electric has spent about 16.5 billion yen to double its output capacity of fiber-optic cables over the past three years. Demand for such cables has increased as 5G radio waves have shorter ranges than those of 4G and thus need more base stations and cables to link them.

Semiconductors used in base stations and other 5G equipment also discharge more heat due to their dense wiring and high-speed transmission, increasing demand for heat-dissipation powder. Tokyo's Tokuyama has invested some 3 billion yen to boost its annual capacity to produce high-purity aluminum nitride powder by 40% to some 840 tons. Tokuyama is the world top producer of high-purity aluminum nitride.

Fuji Chimera Research Institute expects the global market for 5G base stations to grow 38-fold from 2019 to hit 4.19 trillion yen by the end of 2023. It also sees the market for 5G-related electronics devices to increase 7.4-fold to 26.14 trillion yen.